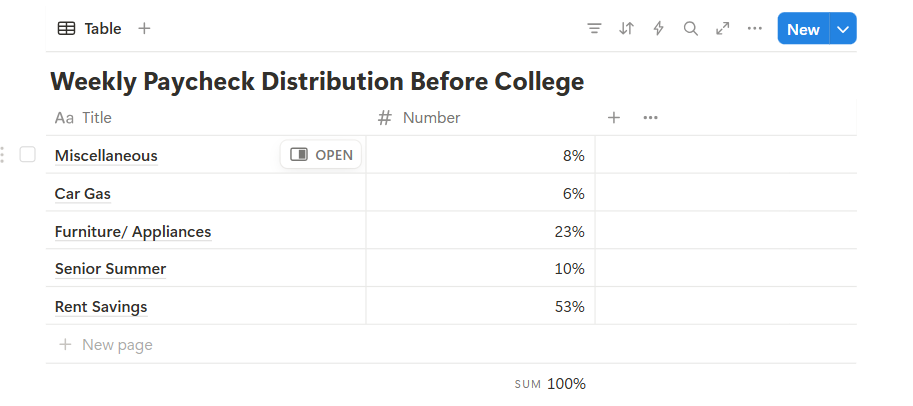

Money unfortunately does not grow on trees. For many low- income seniors, senior year is challenging to go through, but with the right organization methods and cohesive list, it can be manageable. I categorized my expenses in a carefully crafted financial planner on notion. Still, I forgot to consider other expenses that Senior Laura has to pay for College Laura.

We are always told to prepare for the worst, but no one ever tells you to prepare for the best. I am here to urge you to please prepare for the best because sometimes the best is more expensive. Currently I am on a time crunch due to my preparing for the worst mentality. For instance, I unexpectedly got into the University of Florida and now I have to figure out how to get enough money to move out into Gainesville. I fully assumed I would have to stau with my parents for most if not all of college, hoping to just get admitted to UCF. However, fate had other plans and decided to give me the opportunity of attending a top 5 public university, and I took it.

Moreover, prepare to pay for prom, grad bash, cap and gown, and your yearbook. This is how much I personally paid for each thing:

Prom Ticket: $90

Prom Dress: $168

Prom Accessories: $30 (I barely bought anything else)

Grad Bash: $110

Grad Bash Food: $30

Cap and Gown: $80

Yearbook: $75

The total comes to $583, not adding my graduation outfit as well.

Now, these are not all the expenses you have to worry about. If you plan to move out and go to college then you have to consider getting a head start on tuition and fees, books, application fees, apartment down payments, first few months of rent, furniture, starting groceries, and general living expenses. The reality of it comes down to savings and making sure to know how to handle your money. As mentioned previously, I come from a low- income family that has supported me emotionally but is unable to support me financially. This means I have needed to find every loophole and life hack possible to be able to magically pay for every expense and look fabulous while doing it.

I found a high paying part- time job that has helped a lot with paying for things. I cannot urge you enough, if you are of Hispanic origin, to please see if you are eligible to apply for the National Hispanic Recognition Program college board offers. It is the biggest life saver when receiving bright futures. This scholarship can be obtained through multiple means and one of them is receiving that recognition. I was successfully able to get my full tuition paid for by bright futures because I got the recognition and met the 3.5 GPA and 100 volunteer hours requirements. Additionally, there are a lot of low- income resources available. For instance applying to FAFSA as soon as possible enabled me to receive a hefty scholarship that will help me pay for my apartment.

If you know how to sell yourself on your college applications you will also be eligible for additional scholarships the colleges themselves will offer you. Once accepted to a college, about a week later they will send a financial aid package that will show how much federal help you will receive in addition to whatever scholarship they choose to offer you. For me, I was lucky enough to get multiple scholarships from the University of Florida added onto my FAFSA money. This all enables me to pay for my apartment’s rent, books, tuitions and fees, and food. I will not need to work once I am in Gainesville as long as I budget out my scholarship money effectively, enabling me to focus on receiving my Mechanical Engineering degree.

I am beyond grateful for this opportunity and encourage everyone to prepare for the best. My original plan consisted of attending UCF and staying home, meaning that the savings I had I let go of and helped pay bills in my household. However, not of carefully planning caused the surprise acceptance and scholarships to leave me unprepared for what moving out meant. It means buying a bed, coffee table, sofa, pots and pans, cleaning supplies, food, emergency household items, and preparing to pay the first few months of rent as I wait for FAFSA and scholarship money to reach me. Respectively, I highly recommend to apply to the Education Foundation. It is a smaller scholarship but it can be a big help. You would be surprised how much $2,000 truly is when you need to move out in about a month. I finished the application and didn’t click submit because I wanted to look over it. On the day it was due, I came home from my job at 12:04am and realized I was too late. Do not do that and plan previously. Other great scholarship finding websites include but are not limited to Bold.org, FastWeb, BigFutures, and RaiseMe.

It is possible to pay for your senior year alone, all it takes is a little effective planning and focusing on grades to get merit based scholarships. Don’t be afraid to reach out to your school’s college and career counselor, the university’s financial aid advisors, and your managers at work for more hours. You got this, don’t let big numbers scare you!